Texas Purchase & Refinance Mortgage Rates …….

We are from Texas, We are operated in Texas, and We are Texas Strong…..!

All Loans close on-time and within 30 Days or less.

Refinance Rates & Purchase Rates could be lower… have your clients call me to discuss.

30 yr Conventional 4.25% – 0 Discount Points – 0 Origination

15 yr Conventional 3.375% – 0 Discount Points – 0 Origination

20 yr Conventional 4.125% – 0 Discount Points – 0 Origination

10 yr Conventional 3.375% – 0 Discount Points – 0 Origination

30 yr FHA 3.75% – 0 Discount Points – 0 Origination

15 yr FHA 3.25% – 0 Discount Points – 0 Origination

30 yr USDA 3.75% – 0 Discount Points – 0 Origination

30 yr VA 3.75% – 0 Discount Points – 0 Origination

15 yr VA 3.25% – 0 Discount Points – 0 Origination

Jumbo 30 yr Fixed 4.375% – 0 Discount Points – 0 Origination

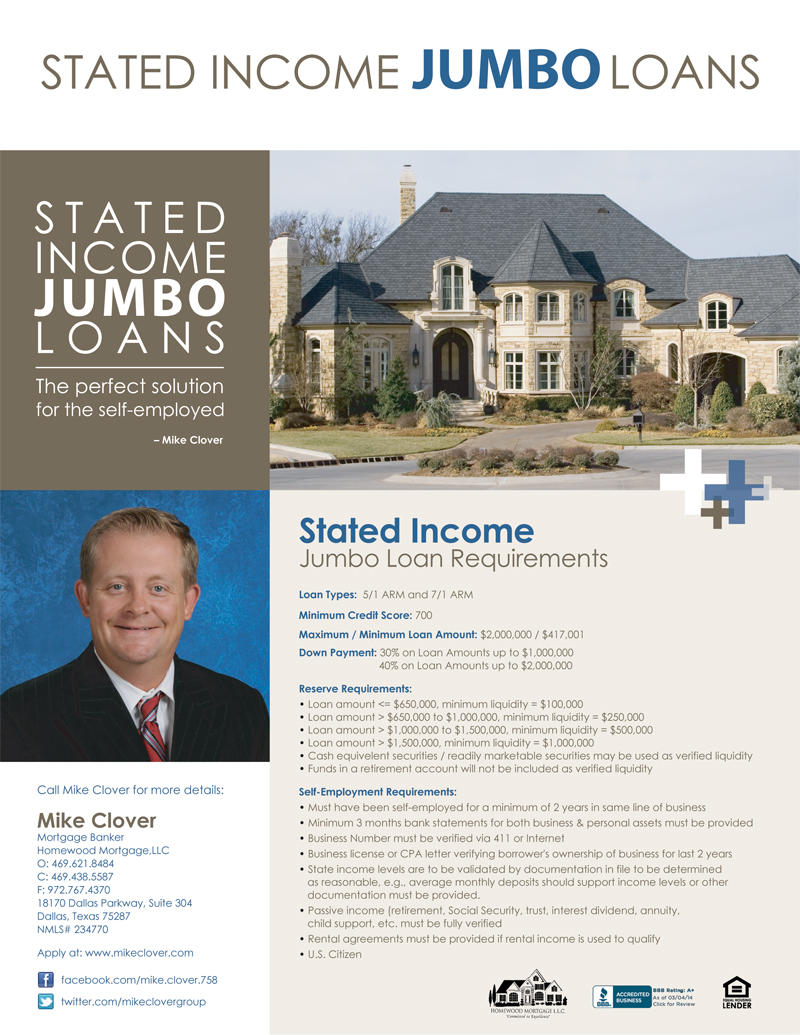

Stated Jumbo 7/1 ARM 5.375% – 0 Discount Points – 0 Origination

Stated Jumbo 5/1 ARM 4.875% – 0 Discount Points – 0 Origination

Your Locally Owned and Operated Texas Mortgage Banker……

Mike Clover

Mortgage Banker

Homewood Mortgage, LLC

Toll FREE: 1-800-223-7409

O: 469-438-5587

F: 972-767-4370

NMLS# 234770

18170 Dallas Pkwy

Ste.304

Dallas, TX 75287

Web: www.mikeclover.com